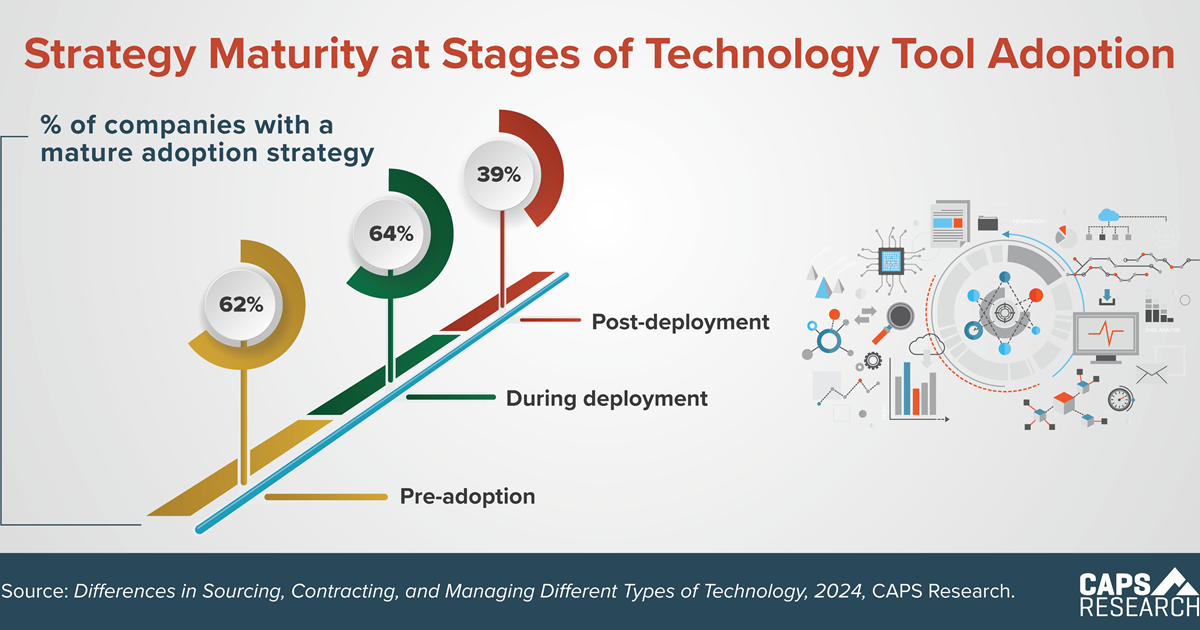

When adopting a new technology tool, 62% of companies indicated they have a well-established and mature strategy for the pre-adoption stage, and 64% have a mature strategy for the deployment stage. Companies with a mature post-deployment strategy drop substantially to 39%. Without a strong strategy in all stages companies will likely experience integration challenges and decreased ROI over time.

Top 3 Challenges

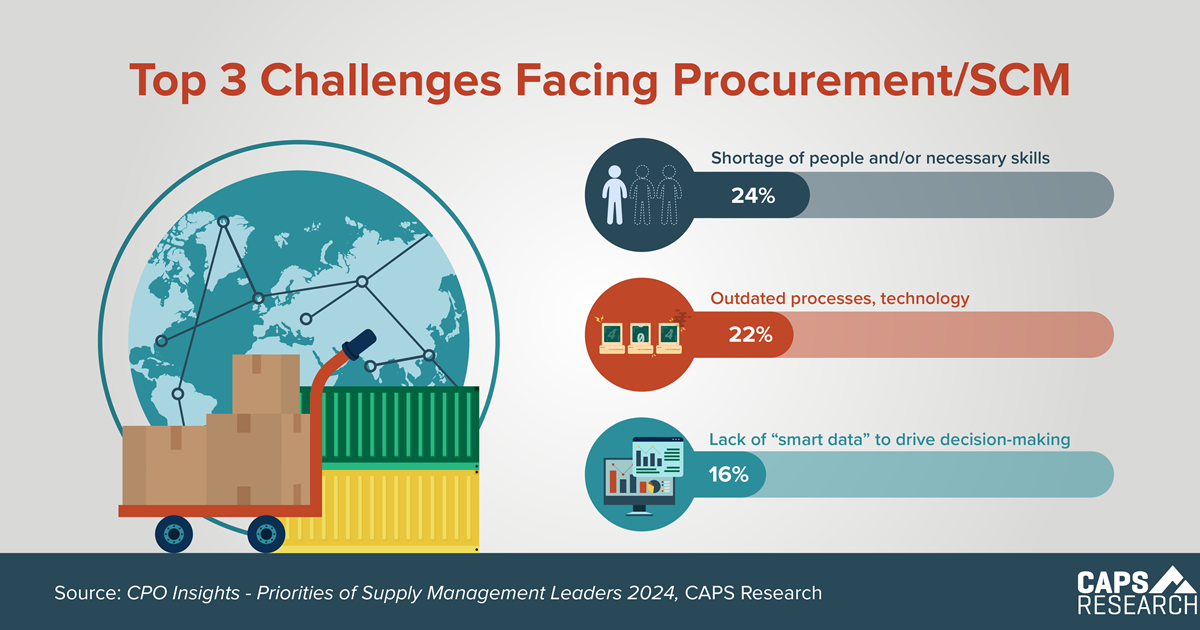

The top challenges facing CPOs is shortage of people and/or necessary skills, followed by outdated processes and technology, and lack of “smart data” to drive decision making. Solutions to these challenges are critical for effective operations and decision-making.

Percentage of SM Employees

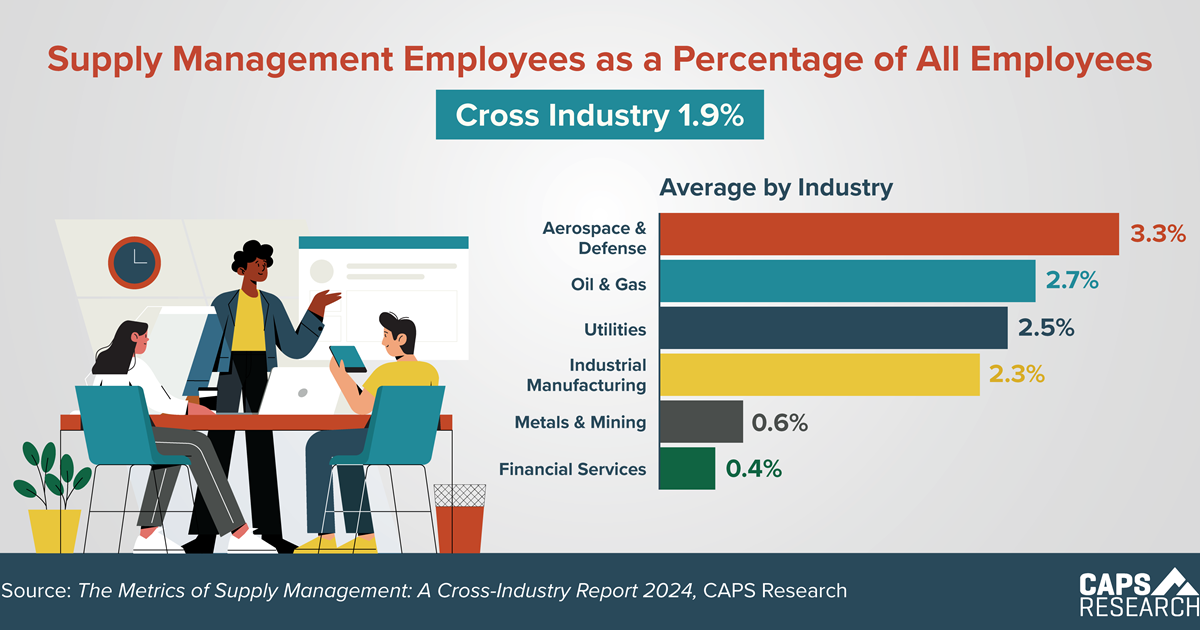

According to the CAPS MoSM Report, only 1.9% of the total headcount across all industries are supply management employees. The number has remained relatively flat the last five years, while the scope and expectations of the function have grown in contrast to other corporate functions. Some have used this metric (along with CAPS’ ROI) to justify an investment in headcount.

Talent Skills Gaps

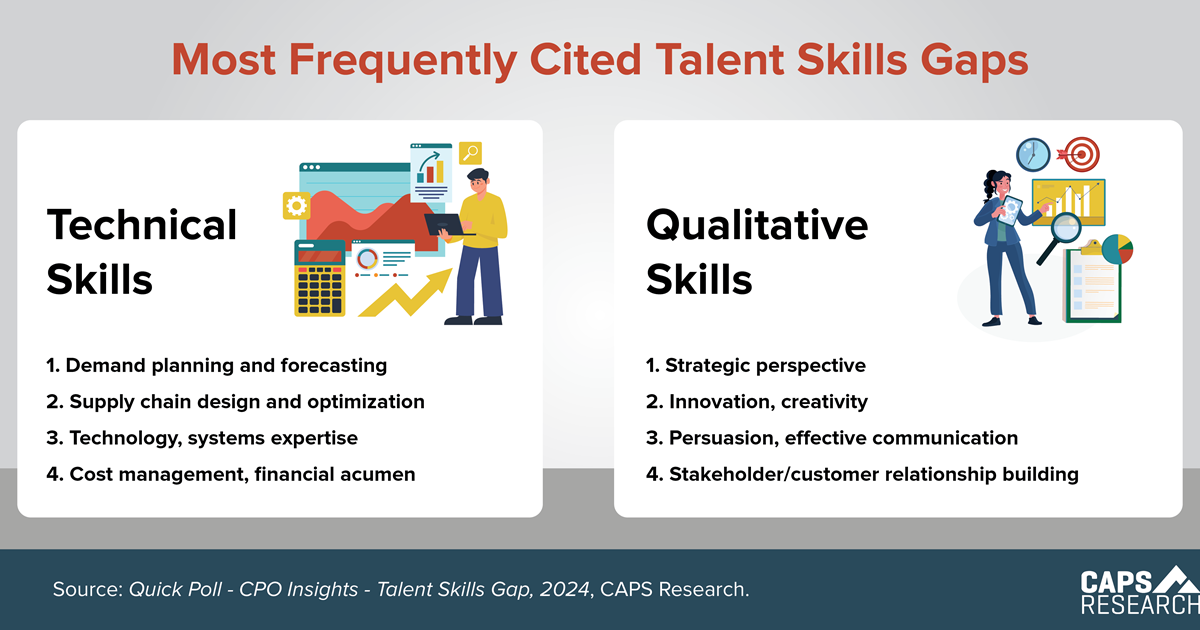

A recent quick poll of supply management leaders revealed the top talent skill gaps. 50% reported the top technical skill gap was demand planning and forecasting, while 67% said the top qualitative skill gap was strategic perspective. Improving skills equates to improving profitability since teams with above median performance deliver greater ROI (Cost reduction/salary expense).

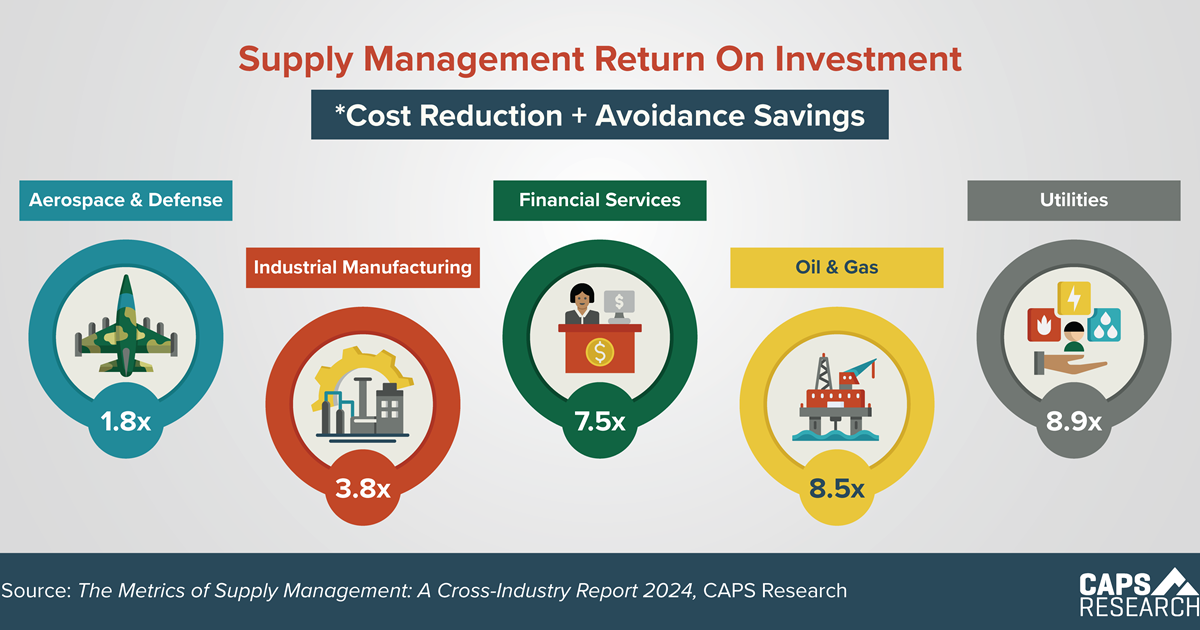

Supply Management ROI

Supply management ROI is a simple way to communicate the value your supply management group delivers to stakeholders. The overall 2024 ROI is 731%. Another way to express ROI is for every US $1 invested in supply management, the function returned $7.31 on average in reduction + avoidance savings. What other function can claim this type of return?

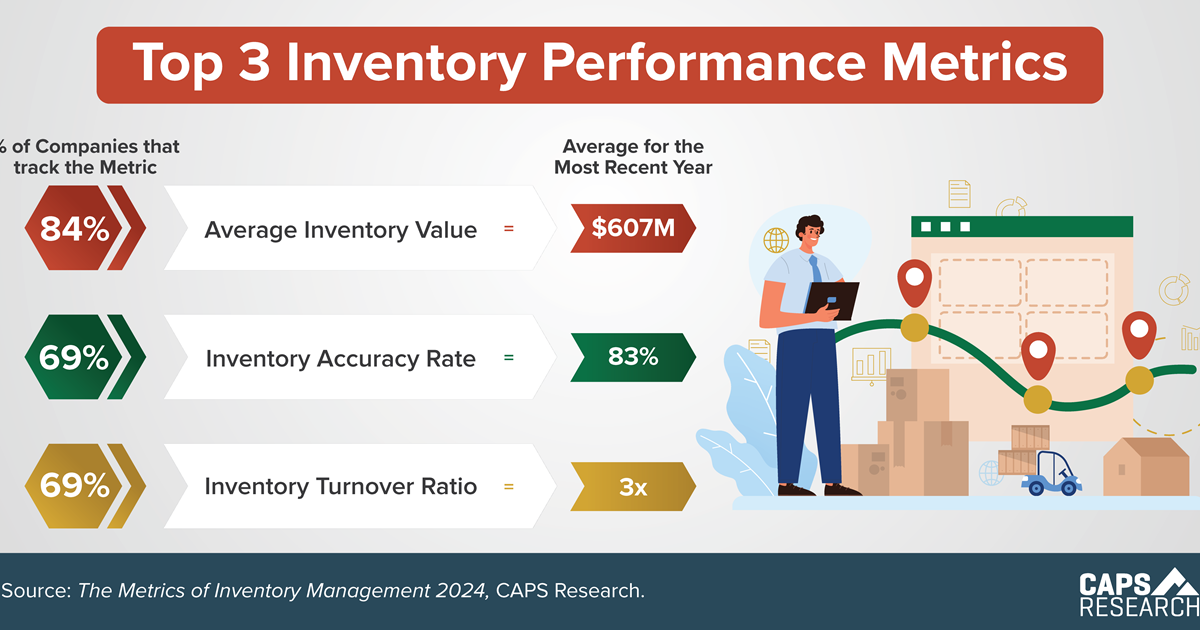

Top Inventory Performance Metrics

The second annual CAPS Research Metrics of Inventory Management report reveals the top 3 inventory performance metrics tracked are Average Inventory Value, Inventory Accuracy Rate, and Inventory Turnover Ratio. Average Inventory Value is a key metric allowing inventory managers to better align their strategies with overall business objectives.

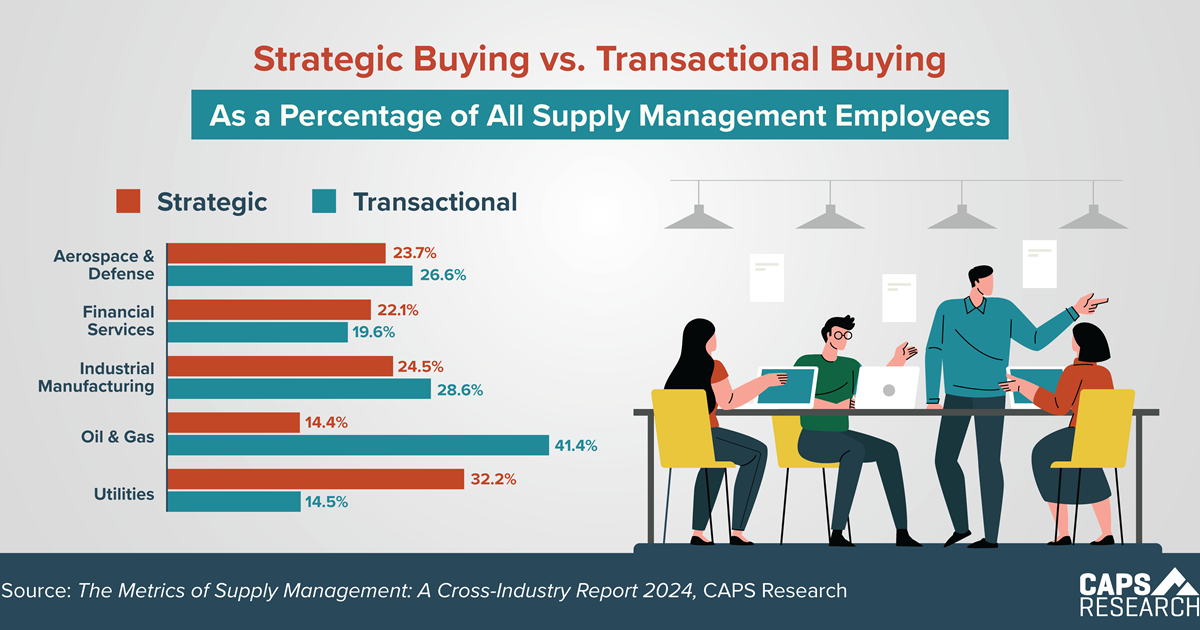

Strategic vs. Transactional Buying

Transactional buying remains the biggest focus for supply management headcount, claiming 29% of resources. Strategic sourcing has the potential to produce greater value, but these resources are a smaller portion of the team mix at 23% overall.

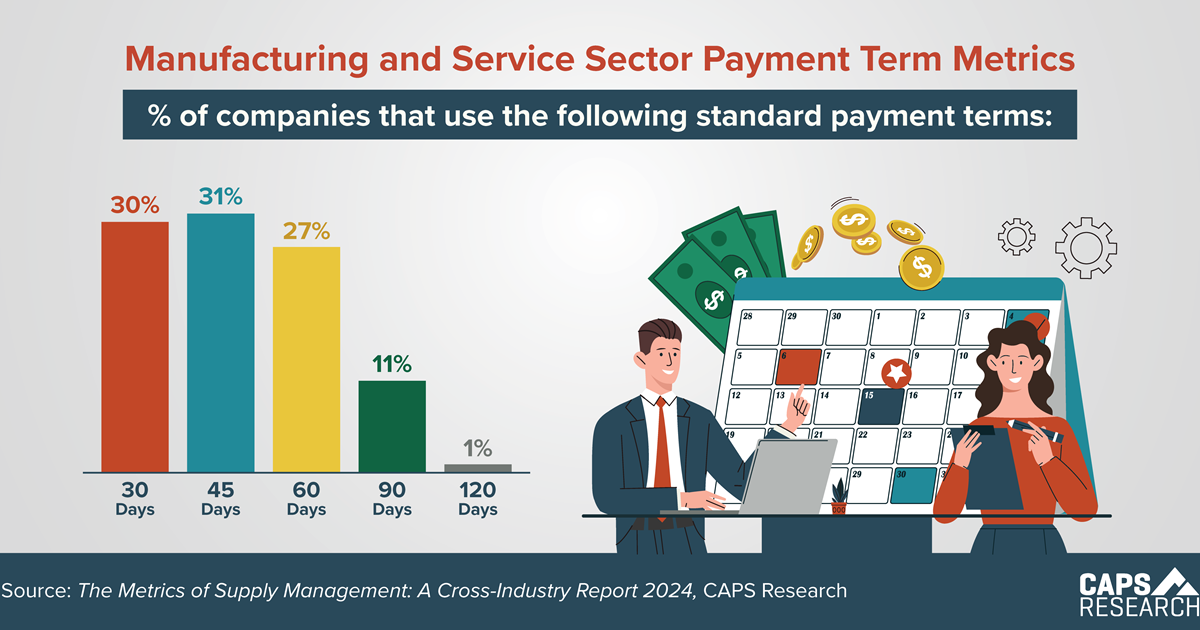

Payment Terms

Across the manufacturing and service sectors the largest percentage of companies, 31%, use 45-day payment terms. Meanwhile 30% use 30-day terms, 27% use 60-day terms, 11% use 90-day terms, and only 1% report using 120-day terms.

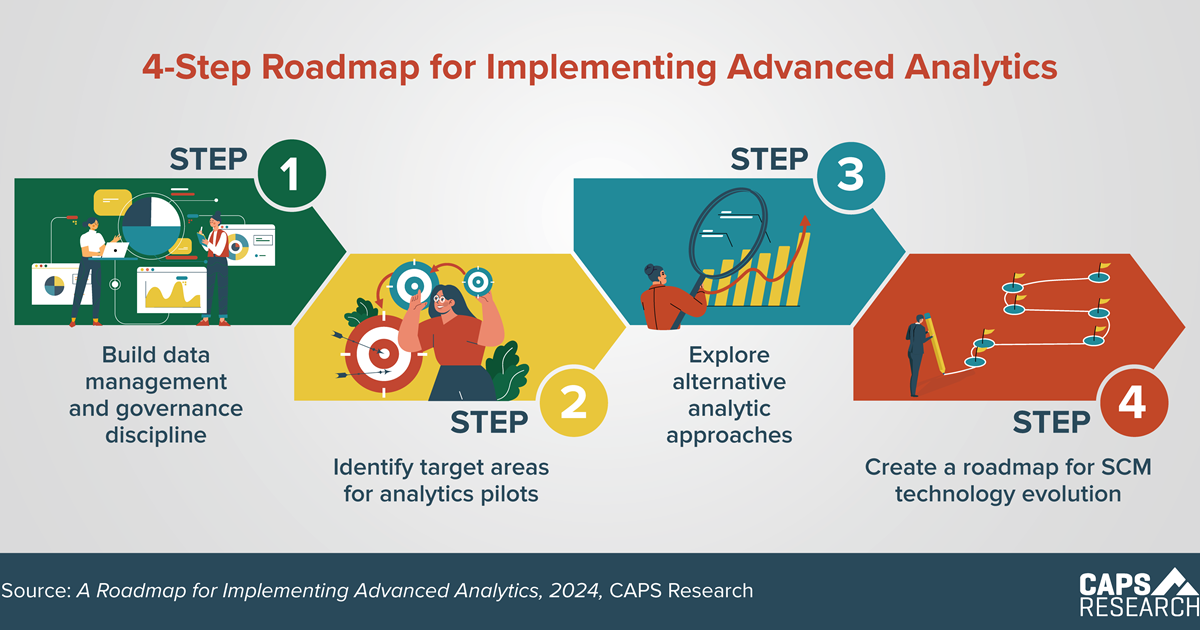

Implementing Advanced Analytics

CAPS Researchers created a 4-step roadmap for the successful adoption and implementation of advanced analytics in supply chain. With the growing importance of data analytics supporting SCM decision-making, it’s critical that companies know the steps to effectively implement advanced analytics.

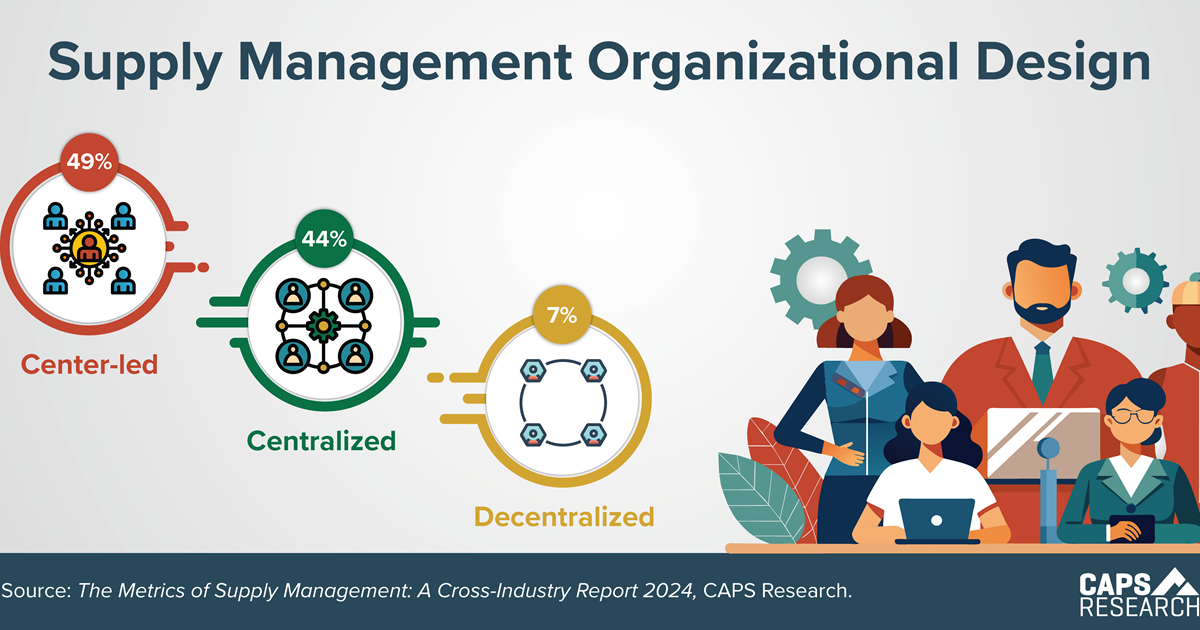

Organizational Design

Over the past couple of years, the Metrics of Supply Management Report shows there has been a slight increase in Center-led companies (+6%) and a decrease in Decentralized (-6%). Companies that undergo organizational structure changes as part of an enterprise-wide initiative or market-driven decision face a huge endeavor, but data indicates these changes don’t happen frequently.

Non-members can receive the report of each survey they submit.

Members can access all reports, but are encouraged to submit surveys to

increase the comparative breakouts only they receive.