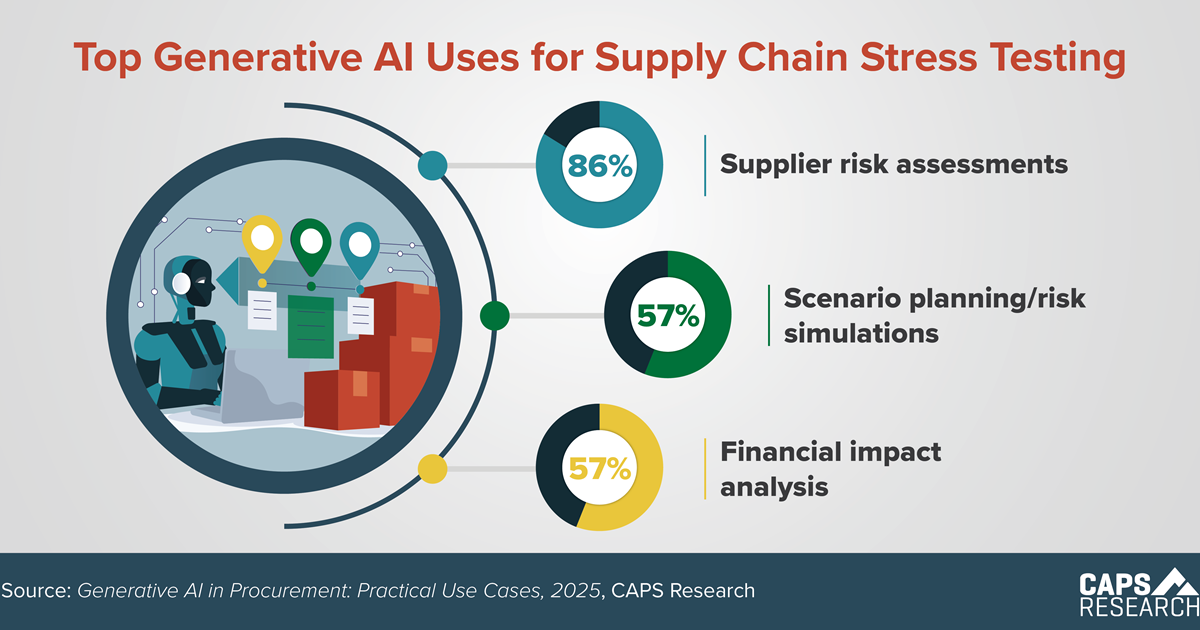

18% of supply chain organizations regularly conduct stress testing using Generative AI for supplier risk assessments, scenario planning/risk simulations, and financial impact analysis. By leveraging AI for these tasks, procurement teams can make more informed, proactive decisions to strengthen resilience and reduce business risk.

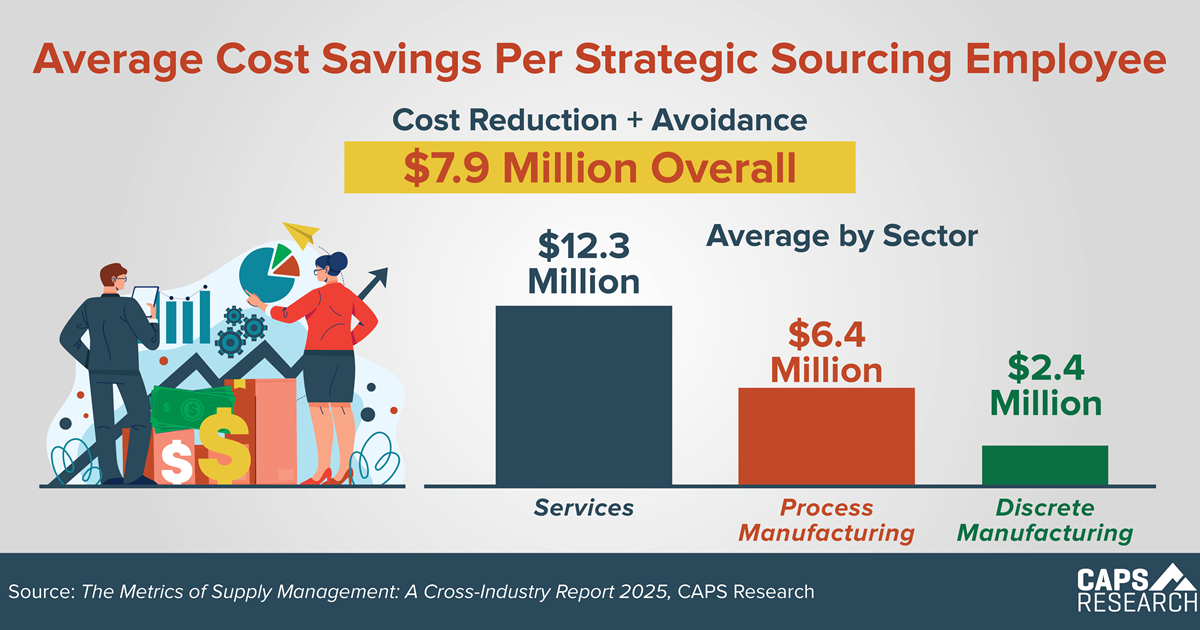

Average Cost Savings

Cost savings is a powerful KPI for demonstrating the value of supply management to the business. On average, strategic sourcing employees are delivering $7.9 million in total savings. How does your team compare?

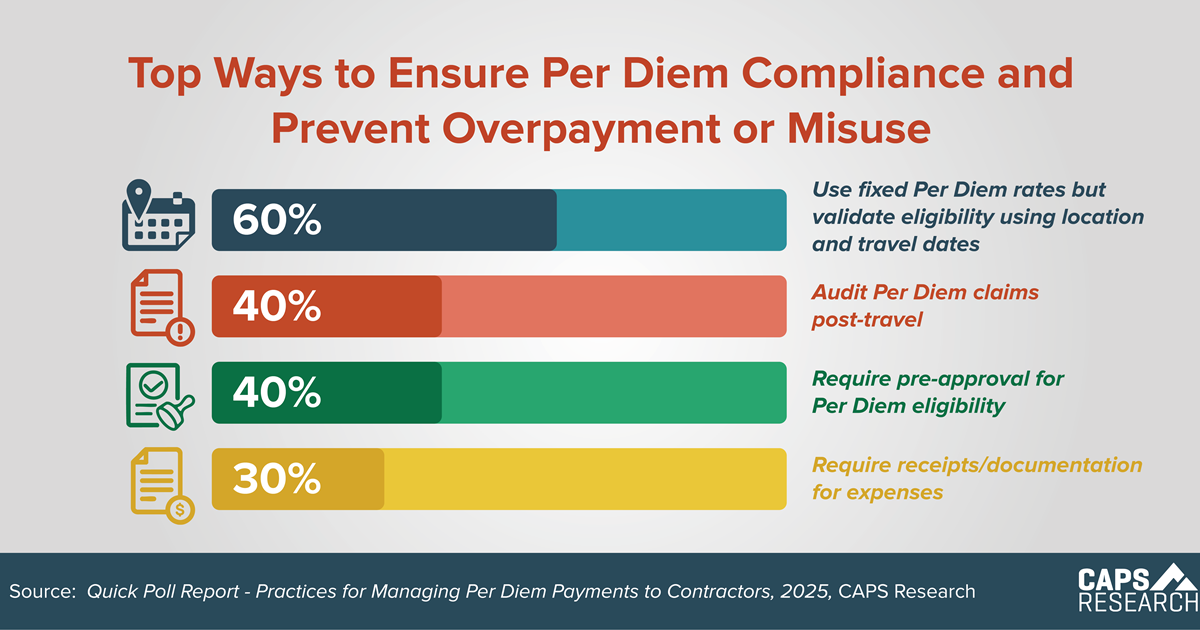

Per Diem Compliance

Most survey respondents use fixed Per Diem allowances, typically using government rates as the cap. However, multiple methods are often used to validate these expenses. Effectively managing Per Diem allowances is essential to controlling project costs and ensuring compliance, especially when 60% of respondents must validate claims by location and travel dates, and many rely on audits and approvals to prevent misuse.

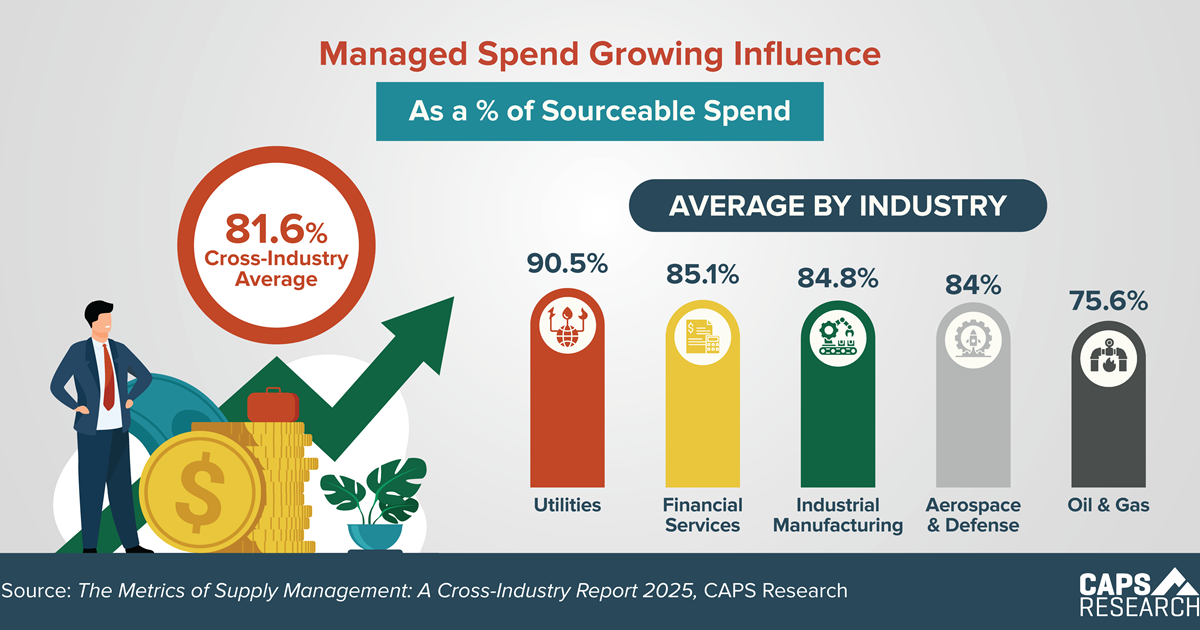

Managed Spend

When the business engages the supply management group in purchasing and sourcing, it can increase savings, better leverage organizational spend, negotiate stronger contracts, and reduce supplier risk. Managed spend, as a percentage of sourceable spend, serves as a primary indicator of a company’s ability to capture value from the supply management process.

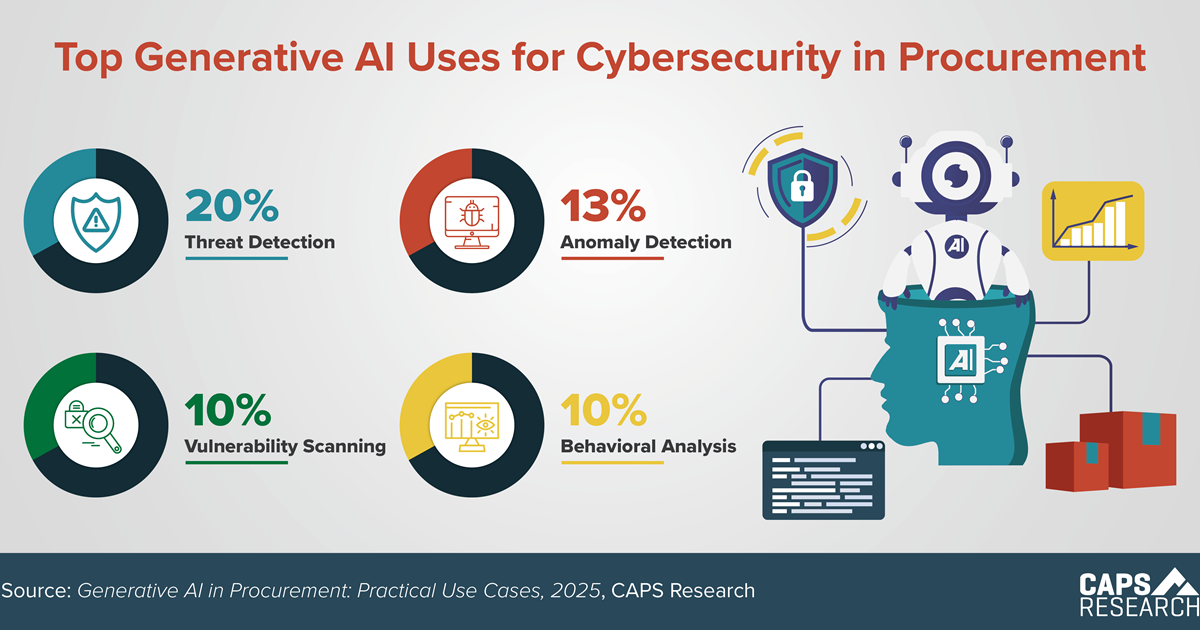

Gen AI for Cybersecurity

Top ways Generative AI is used for cybersecurity in procurement include identifying suspicious activity, monitoring for anomalies, detecting vulnerabilities in systems and networks, and analyzing user behavior to identify threats or compromised accounts. Gen AI provides powerful tools to proactively identify and mitigate cyber risks, helping procurement teams protect sensitive data, ensure supplier integrity, and maintain business continuity.

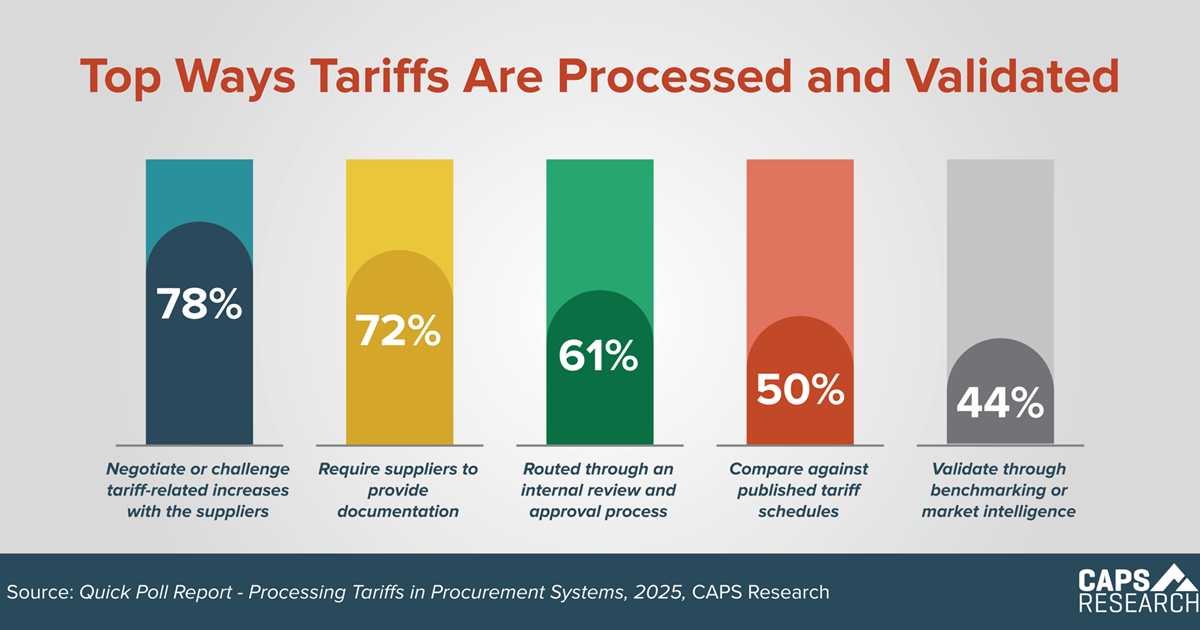

Tariff Validation

Understanding how tariffs are processed and validated is critical for SCM professionals because integrating them into existing workflows often demands supplier coordination, internal alignment, and agile problem-solving, especially when 78% must renegotiate costs and over 70% depend on supplier documentation.

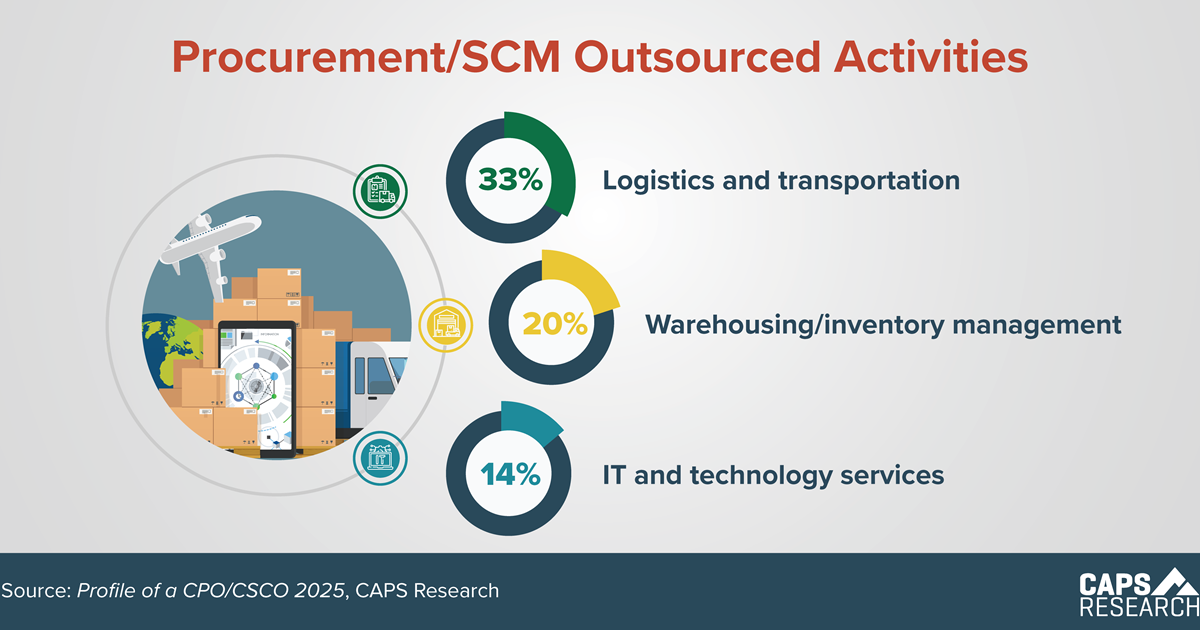

SCM Outsourced Activities

Procurement/SCM leaders currently outsource various services to third-party providers, partially or entirely. 33% outsource logistics and transportation, followed by 20% who outsource warehousing/inventory management and 14% for IT and technology services. Outsourcing select supply chain functions to specialized partners enhances operational efficiency, ensures access to cutting-edge technology and expertise, and enables procurement and SCM teams to concentrate on driving strategic value and long-term competitive advantage.

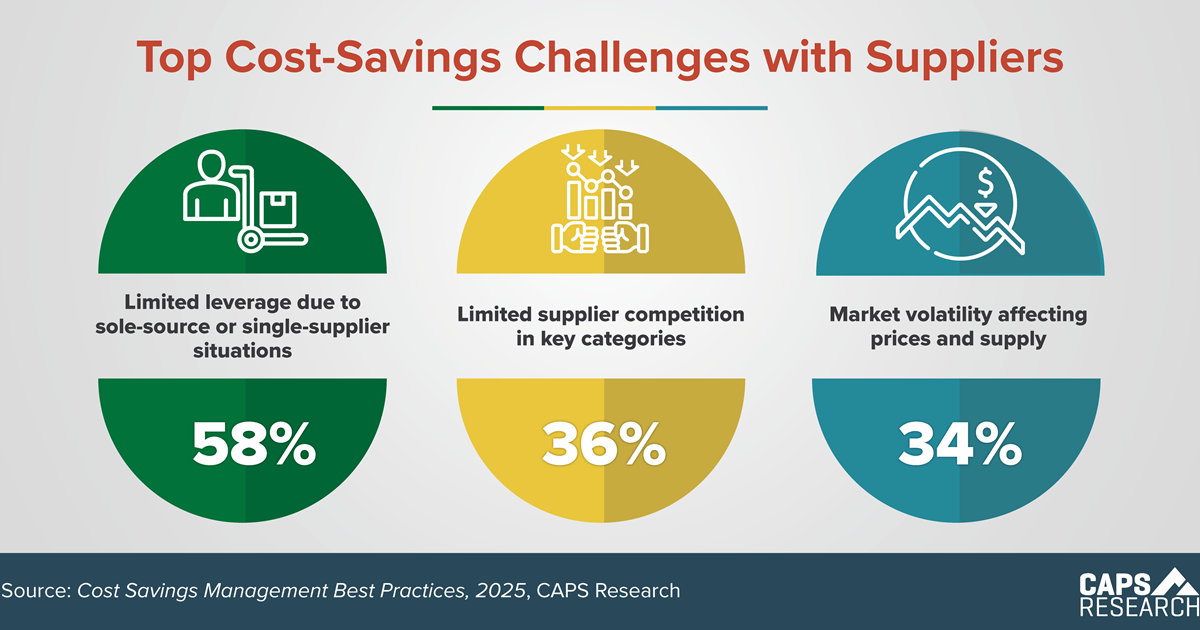

Cost-Savings Challenges

Top challenges Procurement/SCM organizations face with suppliers that affect achieving cost savings include, limited leverage due to sole-source or single-supplier situations, limited supplier competition in key categories and market volatility affecting prices and supply. By proactively addressing these challenges organizations can strengthen their negotiating power, stabilize supply and pricing, and unlock meaningful cost savings, ultimately boosting resilience and competitiveness.

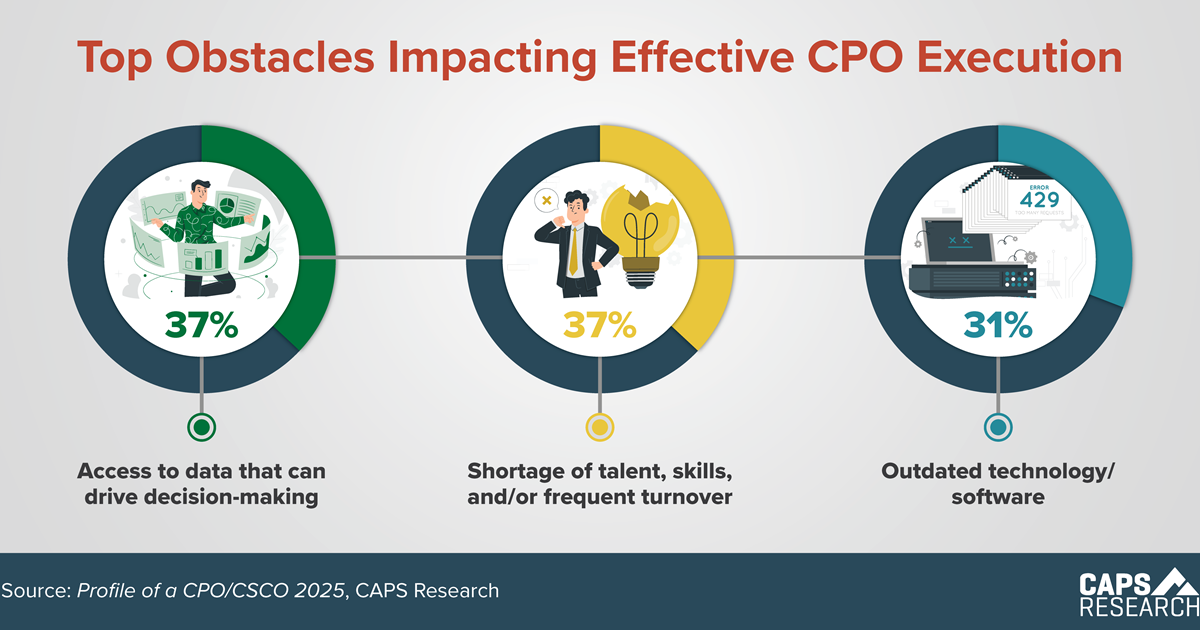

Obstacles Impacting CPO Execution

Procurement/SCM leaders report top obstacles that impact their ability to effectively execute their roles are access to data that can drive decision-making (37%), a shortage of talent, skills, and/or frequent turnover (37%), and outdated technology/software (31%). Removing these obstacles improve operational efficiency, enhance competitiveness, and sustain long-term growth.

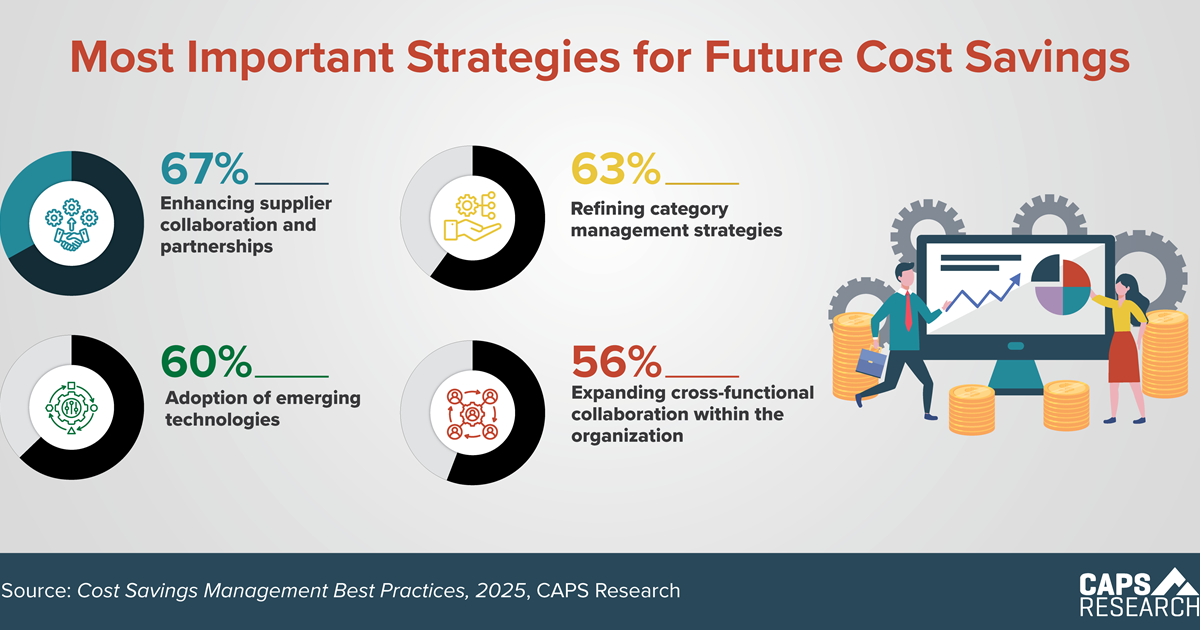

Strategies for Cost Savings

Procurement/SCM leaders consider enhancing supplier collaboration and partnerships, along with refining category management strategies to be strategically important for future cost savings. These are closely followed by adoption of emerging technologies and expanding cross-functional collaboration within the organization. Using these strategies can unlock significant cost-saving opportunities, boost operational efficiency, and contribute to overall organizational success.

Non-members can receive the report of each survey they submit.

Members can access all reports, but are encouraged to submit surveys to

increase the comparative breakouts only they receive.