Cost savings is a powerful KPI for demonstrating the value of supply management (SM) to the business. On average, 21.8% of SM employees are in a strategic sourcing role, each delivering $9.1 million in total savings. How does your company compare?

Total Cost Savings

Cost savings is a cornerstone KPI for most supply management groups, measured here as reduction and avoidance in managed spend. In 2021, Oil and Gas led with 7.1% total cost savings.

Supply Management Org Design

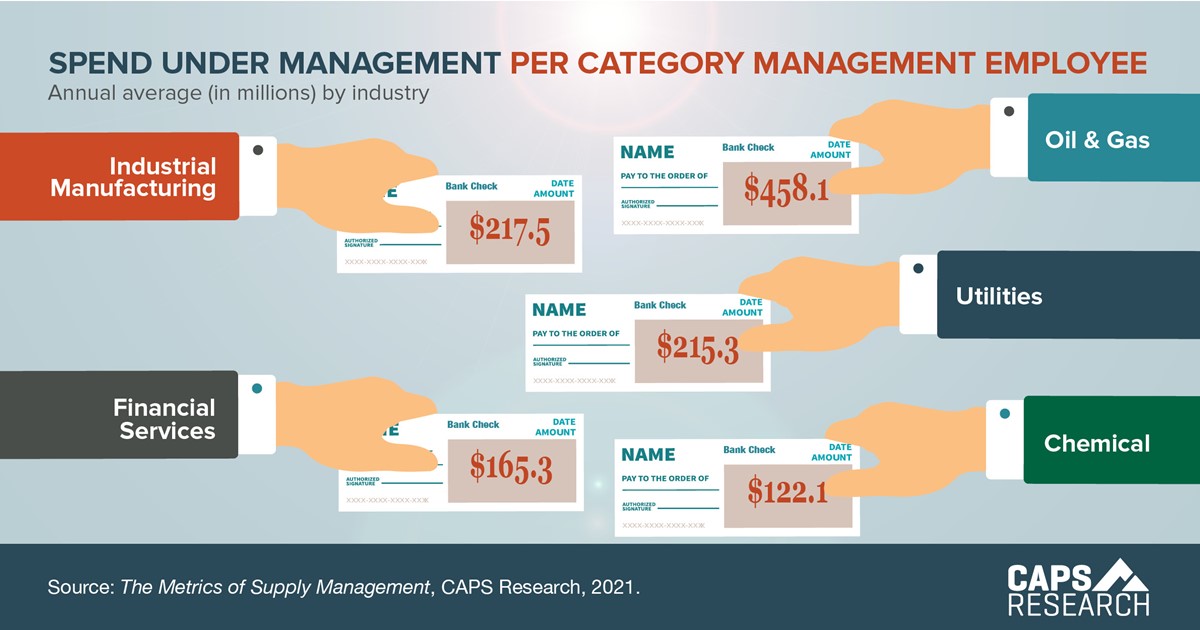

Spend Under Management

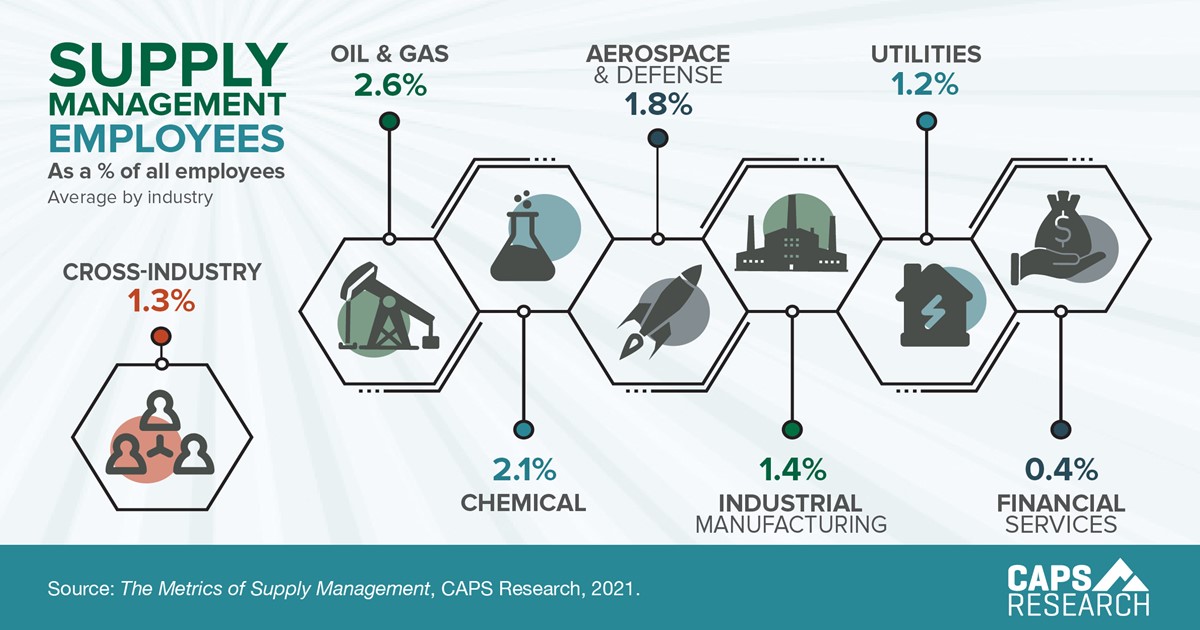

Supply Management Employees

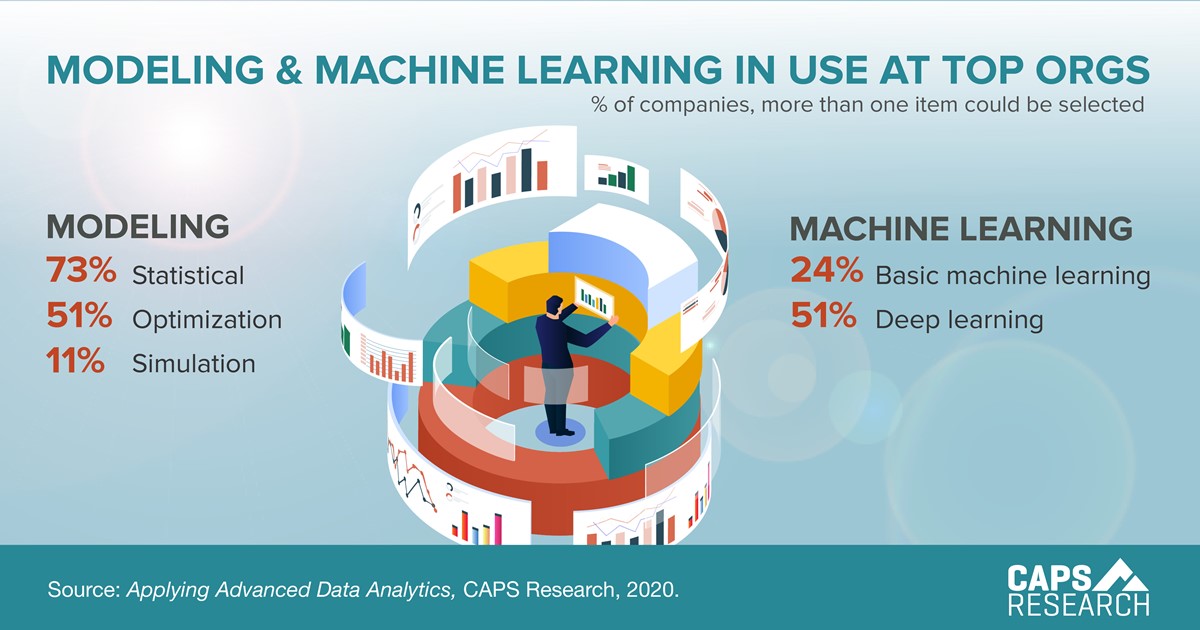

Modeling & Machine Learning In Use at Top Orgs

AI in Supply Management

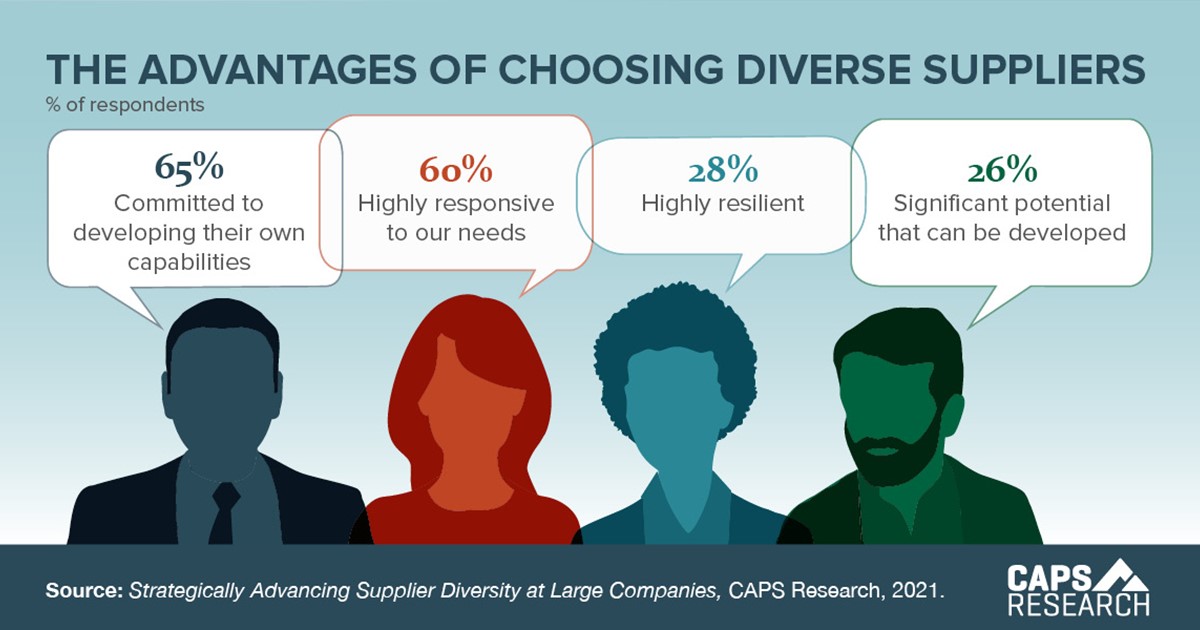

The Advantages of Choosing Diverse Suppliers

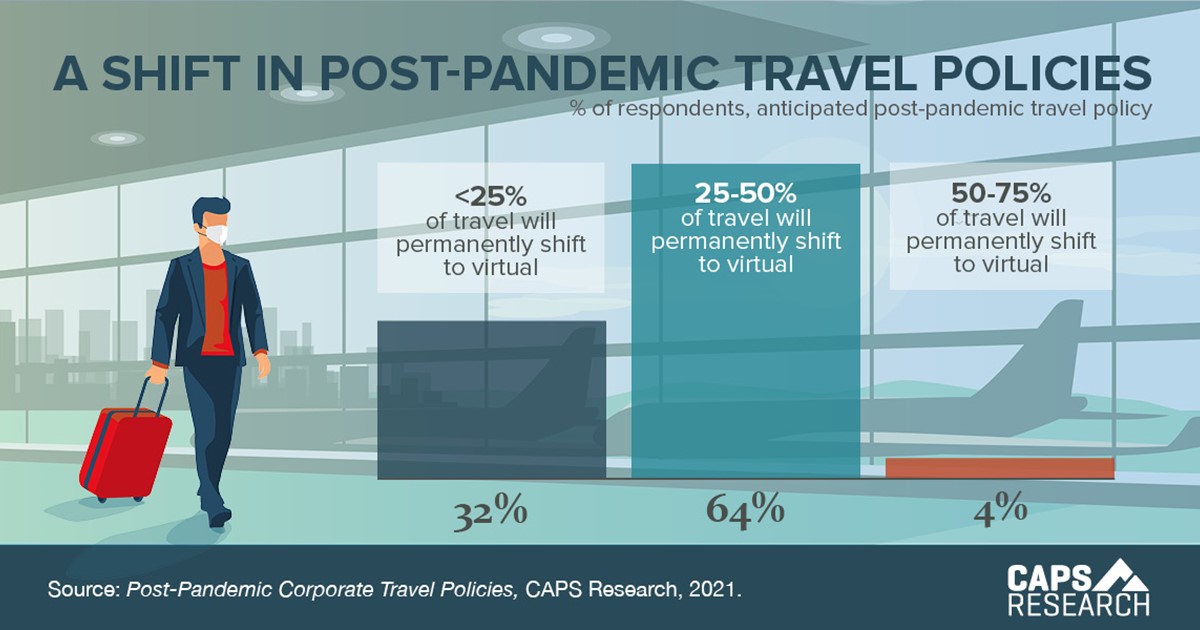

A Shift In Post-Pandemic Travel Policies

Sustainability & Supplier Compliance

Non-members can receive the report of each survey they submit.

Members can access all reports, but are encouraged to submit surveys to

increase the comparative breakouts only they receive.