Contracting and negotiating is the next step in the 7 stages to business-aligned strategies that organizations should follow as part of their category management playbook. It’s an important step in category strategy execution as you align supplier relationships with your strategy.

The process begins with selecting suppliers to support business outcomes, developed with internal and external stakeholders, and ends in the contracting process. More specifically, the execution process can include these activities: taking categories out for bids to increase competition, changing suppliers, re-negotiating contracts terms and timing, outsourcing/insourcing, and executing an SRM strategy to find innovative approaches to restructure supplier relationships, redesign products, and create new revenue streams from waste streams.

This series of posts summarizes the critical information from a recent CAPS whitepaper, A Playbook for Category Management.

7 stages of category management

- Preparation

- Internal Analysis

- External Analysis

- Category Strategy Development

- Negotiation and Contracting

- Supplier Relationship Management

- Category Performance Management

Supplier categories

Typically, an organization retains a list of suppliers they turn to during the sourcing process. That list may include the following types of suppliers:

- Preferred: Typically, the first choice due to meeting the expectations for quality, delivery, and price, and can respond to unexpected changes.

- Partnered: Suppliers with a close relationship – not necessarily a formal one – that offer advantages for both buyers and sellers.

- Approved: Suppliers that meet the buyer’s selection criteria and have been added to the approved list.

- Certified: Suppliers with quality-control systems that meet specific requirements, such as food safety.

- Prequalified: Suppliers that meet preliminary screening criteria.

- Certifiable: Suppliers that are not currently certified but present substantial evidence to become certified.

- Diverse: Suppliers that increase the diversity of the buyer’s supply base. A business that is at least 51% owned and operated by an individual or group that is part of a traditionally underrepresented or underserved group.

Supplier sourcing

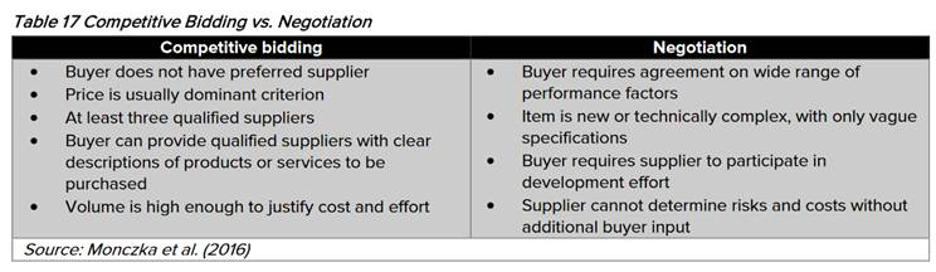

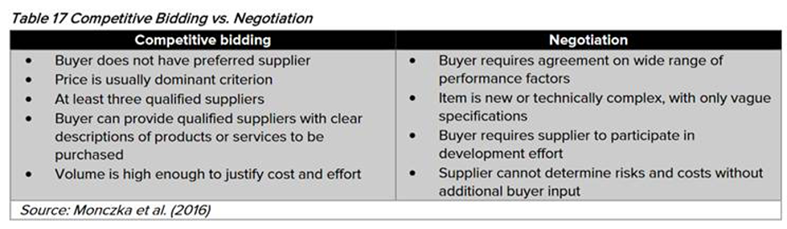

If there are no preferred or partnered suppliers, organizations will commonly select suppliers through competitive bidding and negotiation. This chart highlights differences between competitive bidding and negotiating with individual suppliers.

Source: A Playbook for Category Management, CAPS Research, November 2020.

The negotiation and contracting stage should support your category strategy with mutually beneficial supplier relationships that deliver value beyond low-cost bids.

Contracting best practices

- Determine whether the contract is a site, business-unit, or organization-wide agreement

- Differentiate the contract type

- Determine the length of agreement from short- to longer-term

- Define contract templates to be employed

- Use contractual allocation of risk (CARM) as a tool to identify and allocate risks in contracts

The final supplier selection decision should not be based solely on lowest price, but should include other criteria related to business drivers, such as innovative capability, responsiveness, quality, and flexibility related to the long-term cost of doing business.

In some organizations, the category team (with representation from the business unit), the sourcing representative, and the category manager, have responsibility for contracting and negotiation. In other organizations, however, only the sourcing manager has contracting and negotiation responsibility. With the category strategy in hand and suppliers on board, it's time to create long-term value for the organization.

The next post examines Stage 6: Supplier Relationship Management. In this stage, the organization engages in supplier relationship building and performance monitoring for long-term mutual value.

From the CAPS Research whitepaper, A Playbook for Category Management, CAPS Research, November 2020.

Members get priority access

Explore the entire CAPS Library

Reports released within the last four years are reserved for members, but anyone may create a free account in the CAPS Library and access more than 30 years of KPIs, best practices, and thought leadership. Employees of CAPS member companies can access the full report in the CAPS Library now.

Members: download this report Learn more about CAPS membership

Non-members can receive the report of each survey they submit.

Members can access all reports, but are encouraged to submit surveys to

increase the comparative breakouts only they receive.